Куда вложить деньги? Инвестирование в интернете. Вложение средств в pamm-счета. Блог памм-инвестора.

- Главная

-

- Browse more categories

- к2капитал

- berg.com.ua

- http://berg.com.ua/people/profile/buffet-portfolio/

- http://corp.cnews.ru/news/line/index.shtml?2011/03/05/430954

- http://fifthdown.blogs.nytimes.com/2012/01/09/what-tebow-said-after-beating-steelers-no-mention-of-316/

- http://forexorg.net/main/334-skolko-mozhno-zarabotat-na-trejdinge-cherez-internet-mnogo.html

- http://forexorg.net/main/350-forex-biznes-ili-kazino.html

- http://forexorg.net/main/367-gde-zarabotat-dengi-mirovoj-valyutnyij-ryinok.html

- http://forexorg.net/main/391-glenn-nili.html

- http://forexorg.net/main/649-torgovat-na-valyutnom-ryinke-foreks-prosto.html

- http://forexorg.net/main/679-istoriya-bena-uorvika.html

- http://fxnotes.ru/igryi-razuma/

- http://k2kapital.com/

- http://k2kapital.com/news/476679/

- http://k2kapital.com/news/503215/

- http://k2kapital.com/news/509581/

- http://k2kapital.com/news/509804/

- http://k2kapital.com/news/510895/

- http://k2kapital.com/news/511913/

- http://k2kapital.com/news/513038/

- http://k2kapital.com/news/529072/

- http://k2kapital.com/news/532793/

- http://k2kapital.com/news/537609/

- http://k2kapital.com/news/544747/

- http://k2kapital.com/news/547230/

- http://k2kapital.com/news/556475/

- http://k2kapital.com/news/609300/

- http://k2kapital.com/quote/goods/504564/

- http://k2kapital.com/quote/goods/549345/

- http://k2kapital.com/weekly/stories/192537/

- http://k2kapital.com/weekly/stories/560974/

- http://k2kapital.ru/news/

- http://stockinfocus.ru/2011/12/08/kto-zarabotal-na-bankrotstve-lehman-brothers/

- http://stockinfocus.ru/2011/12/15/nuriel-rubini-prognoz-2012/

- http://stockinfocus.ru/2011/12/20/eurusd-prognoz-na-pervyj-kvartal-2012/

- http://top.rbc.ru/economics/07/03/2011/554937.shtml

- http://top.rbc.ru/economics/07/03/2011/555297.shtml

- http://ubr.ua/finances/stock-market/rudnyi-god-dlia-zolota-117426

- http://www.bcs-express.ru/digest/?article_id=68757

- http://www.bloomberg.com/news/2011-02-03/ecb-seeks-to-shift-uncomfortable-bond-buying-to-rescue-fund-euro-credit.html

- http://www.bloomberg.com/news/2011-02-03/english-signals-new-zealand-fiscal-tightening-lessens-need-for-rate-rise.html

- http://www.bloomberg.com/news/2011-02-03/trichet-fights-to-curb-pay-pressures-as-euro-region-s-inflation-quickens.html

- http://www.finmarket.com.ua/ru/commodities/

- http://www.finmarket.com.ua/ru/news_forex/

- http://www.finmarket.net/ru/found_brouse/

- http://www.forexpf.ru/news/2011/03/07/a0ig-prognozy-bankov-po-tsenam-dragotsennykh-metallov-na-2011-god.html

- http://www.forextimes.ru/foreks-stati/procentnye-stavki-i-ix-vliyanie-na-kursy-valyut

- http://www.forextraders.com/forex-analysis/famous-traders.html

- http://www.foxnews.com/politics/2012/01/07/gop-rivals-go-after-romney-in-new-hampshire-debate/

- http://www.k2kapital.com/news/529817/

- http://www.k2kapital.com/news/530328/

- http://www.k2kapital.com/news/536914/

- http://www.k2kapital.com/news/539254/

- http://www.k2kapital.com/news/609989/

- http://www.marketwatch.com/story/campus-holdings-acquires-shares-in-ambow-education-2012-01-09

- http://www.trade-ua.com/news/markets/p_1_at90_id244/

- k2kapital

- progi-forex

- Take-profit.org

Pages

interesting pages

Технологии Blogger.

Читатели

Поиск по этому блогу

Archives

forex4you

Мы предоставляем широкий выбор счетов, Вы найдете подходящие условия торговли независимо от своего уровня: "Cent" для самообучения, "Cent NDD" для доступного выхода на межбанковский валютный рынок; "Classic Lite" для тех, кто научился зарабатывать; «Classic» для опытных трейдеров и "Pro" для профессионалов рынка Forex.

Условия работы Forex4you:

- Самые современные технологии: плавающий spread от 0,5 пункта, Marker Execution, BBO, Market Depth, One Click Trading;

- Cпособы ввода/вывода средств: банковские карты, электронные деньги, платежные терминалы, мобильные платежи и переводы между внутренними счетами клиента;

- Автоматический ввод/вывод: в течение нескольких минут;

- Торговый терминал: самый популярный и надежный - Meta Trader 4 + мобильные версии для Ваших портативных устройств;

- Информационная поддержка: новостная лента от крупнейшего мирового агентства Dow Jones Newswires (UK), аналитика и прогнозы от Trading Central (US);

- Удобный интерфейс «Личный Кабинет»: управление Вашими торговыми счетами;

- «Разбор полетов»: бесплатный сервис анализа Вашей торговой активности в Личном Кабинете;

- Техническая поддержка: круглосуточно LiveChat на сайте и бесплатная горячая линия 24/5;

- Представительства и офисы: более чем в 50 регионах РФ, СНГ и ближнего зарубежья;

- Акции и конкурсы: на постоянной основе;

- Партнерские программы: для владельцев сайтов, офисов, а также трейдеров.

Куда вложить деньги? Инвестирование в интернете. Вложение средств в pamm-счета. Блог памм-инвестора.: января 2012 - forex4you

forex4you лучший брокер

Мы предоставляем широкий выбор счетов, Вы найдете подходящие условия торговли независимо от своего уровня: "Cent" для самообучения, "Cent NDD" для доступного выхода на межбанковский валютный рынок; "Classic Lite" для тех, кто научился зарабатывать; «Classic» для опытных трейдеров и "Pro" для профессионалов рынка Forex.

Условия работы Forex4you:

- Самые современные технологии: плавающий spread от 0,5 пункта, Marker Execution, BBO, Market Depth, One Click Trading;

- Cпособы ввода/вывода средств: банковские карты, электронные деньги, платежные терминалы, мобильные платежи и переводы между внутренними счетами клиента;

- Автоматический ввод/вывод: в течение нескольких минут;

- Торговый терминал: самый популярный и надежный - Meta Trader 4 + мобильные версии для Ваших портативных устройств;

- Информационная поддержка: новостная лента от крупнейшего мирового агентства Dow Jones Newswires (UK), аналитика и прогнозы от Trading Central (US);

- Удобный интерфейс «Личный Кабинет»: управление Вашими торговыми счетами;

- «Разбор полетов»: бесплатный сервис анализа Вашей торговой активности в Личном Кабинете;

- Техническая поддержка: круглосуточно LiveChat на сайте и бесплатная горячая линия 24/5;

- Представительства и офисы: более чем в 50 регионах РФ, СНГ и ближнего зарубежья;

- Акции и конкурсы: на постоянной основе;

- Партнерские программы: для владельцев сайтов, офисов, а также трейдеров.

Куда вложить деньги? Инвестирование в интернете. Вложение средств в pamm-счета. Блог памм-инвестора.: января 2012 - forex4you лучший брокер

forex4you luchshij broker

Мы предоставляем широкий выбор счетов, Вы найдете подходящие условия торговли независимо от своего уровня: "Cent" для самообучения, "Cent NDD" для доступного выхода на межбанковский валютный рынок; "Classic Lite" для тех, кто научился зарабатывать; «Classic» для опытных трейдеров и "Pro" для профессионалов рынка Forex.

Условия работы Forex4you:

- Самые современные технологии: плавающий spread от 0,5 пункта, Marker Execution, BBO, Market Depth, One Click Trading;

- Cпособы ввода/вывода средств: банковские карты, электронные деньги, платежные терминалы, мобильные платежи и переводы между внутренними счетами клиента;

- Автоматический ввод/вывод: в течение нескольких минут;

- Торговый терминал: самый популярный и надежный - Meta Trader 4 + мобильные версии для Ваших портативных устройств;

- Информационная поддержка: новостная лента от крупнейшего мирового агентства Dow Jones Newswires (UK), аналитика и прогнозы от Trading Central (US);

- Удобный интерфейс «Личный Кабинет»: управление Вашими торговыми счетами;

- «Разбор полетов»: бесплатный сервис анализа Вашей торговой активности в Личном Кабинете;

- Техническая поддержка: круглосуточно LiveChat на сайте и бесплатная горячая линия 24/5;

- Представительства и офисы: более чем в 50 регионах РФ, СНГ и ближнего зарубежья;

- Акции и конкурсы: на постоянной основе;

- Партнерские программы: для владельцев сайтов, офисов, а также трейдеров.

OPEN A FOREX ACCOUNT

Каждый может открыть счёт у брокеров:

alpari

forex4you

instaforex

Кто может зарабатывать на форекс?

- трейдер, которые прошел путь от А до Я биржевого спекулянта.

- форекс партнёр

alpari

forex4you

instaforex

- инвестор памм-счета:

alpari

forex4you

instaforex

Успехов на рынке форекс!

OTKRIT FOREX SCHET

FOREX ТОРГОВЛЯ ОЧЕНЬ ТРУДНА И ОПАСНА, ПСИХОЛОГИЧЕСКИ ТРУДНА.

ИЗ 100% ТРЕЙДЕРОВ ВЫЖИВАЮТ ЛИШЬ 5-3%.

ОТКРЫТЬ ФОРЕКС СЧЁТ У ЛУЧШИХ БРОКЕРОВ

alpari

forex4you

instaforex

OTKRIT FOREX SCHET МОЖЕТ КАЖДЫЙ НО НЕ КАЖДЫЙ МОЖЕТ ПРИБЫЛЬНО ТОРГОВАТЬ.

Лучшие форекс партнёрки

alpari

forex4you

instaforex

Campus Holdings buy Shares Ambow

Campus Holdings Acquires Shares in Ambow Education

Куда вложить деньги? Инвестирование в интернете. Вложение средств в pamm-счета. Блог памм-инвестора.: января 2012 - Campus Holdings buy Shares Ambow

Tim Tebow

What Tebow Said After Beating Steelers; No Mention of 3:16

By TONI MONKOVIC— Tim Tebow on his reaction to Demaryius Thomas’s touchdown in overtime

“I don’t know if I felt extra pressure from it. I knew it was a big game. We had a great week of practice—we practiced hard—and I felt like we had a great game plan, and we were playing a very good Pittsburgh Steelers team. They came out and they played hard, and we played hard, and it was a great game, and I’m very thankful we were able to get the win.

“It’s a great call, first of all. It’s something we had ran earlier in the game. Just off some of our zone-read stuff, [Pittsburgh was] bringing the safeties, playing, like, a Blitz Zero look but not blitzing the [linebackers] inside. It was a great call by Coach [offensive coordinator Mike] McCoy. We wanted to try and get [WR Demaryius Thomas] in there, behind the safeties blitzing, and he did a great job getting off the corner and just waiting for the pass through the second window from the backer, and [I] just tried to fit it in there, and he made a great catch and a great run after the catch, and the offensive line blocked phenomenal. It was also a great call. It’s a pretty good fake, and [RB] Willis [McGahee] really sold it, and the [offensive] line really sold it, so [Pittsburgh] couldn’t really get a lot of pressure, and [Thomas] made a heck of a play.”

“I think a lot of different guys stepped up and made plays, including [Thomas]. He just did a great job. I think the coaches coached him up well this week on how to attack the corners and giving him a lot of different looks, with splits, with timing, with the different play actions, double moves, and he did a great job with it and just made a bunch of big plays.”

“I think it’s just a mentality, being aggressive. Whether it’s in the pocket, when I was stepping up and I start to scramble, which we got a few first downs on that, [or] whether it’s when I’m stepping up and giving a receiver an opportunity on a deep ball. Like, early, on third down, beginning of the second quarter, when I hit [WR Demaryius Thomas] down the sideline—that’s a play I was being very aggressive, trusting him. I couldn’t see exactly where the [defensive back] was—it was kind of a broken play—[I] just trusted him, and he made a great play.”

politics debats

Read more: http://www.esquire.com/blogs/politics/new-hampshire-debate-analysis-6634955#ixzz1ir8xjCNR

start new hampshire debate

GOP Rivals Go After Romney in New Hampshire Debate

APJan. 7, 2012: Former Massachusetts Gov. Mitt Romney, left, answers a question as former Pennsylvania Sen. Rick Santorum listens during a Republican presidential candidate debate at Saint Anselm College in Manchester, N.H.

APJan. 7, 2012: Former Massachusetts Gov. Mitt Romney, left, answers a question as former Pennsylvania Sen. Rick Santorum listens during a Republican presidential candidate debate at Saint Anselm College in Manchester, N.H.

Read more: http://www.foxnews.com/politics/2012/01/07/gop-rivals-go-after-romney-in-new-hampshire-debate/#ixzz1ir8ojQph

трейдеры - научные кролики

Научные исследования, доказывающие, что люди, которые имеют дело с акциями и играют на бирже, хуже психопатов, подвержены влиянию Луны и не нуждаются в здоровом мозге.

Трейдеры эгоистичнее, чем психопаты

исследование

приняли участие 24 пациента немецких клиник с диагнозом «психопатия», подразумевающем, в частности, неспособность к эмпатии и безответственность.

приняли участие 24 пациента немецких клиник с диагнозом «психопатия», подразумевающем, в частности, неспособность к эмпатии и безответственность.результаты

Спокойствие приносит успех

исследование

обучения добровольцам предложили заполнить еще две анкеты. Первая позволяла психологам понять, какую часть жизни респондент, по его мнению, контролирует самостоятельно, какая находится под влиянием других людей, а какая зависит лишь от случая. Во второй анкете вновь оценивался уровень подавленности и беспокойства трейдеров.

обучения добровольцам предложили заполнить еще две анкеты. Первая позволяла психологам понять, какую часть жизни респондент, по его мнению, контролирует самостоятельно, какая находится под влиянием других людей, а какая зависит лишь от случая. Во второй анкете вновь оценивался уровень подавленности и беспокойства трейдеров.результаты

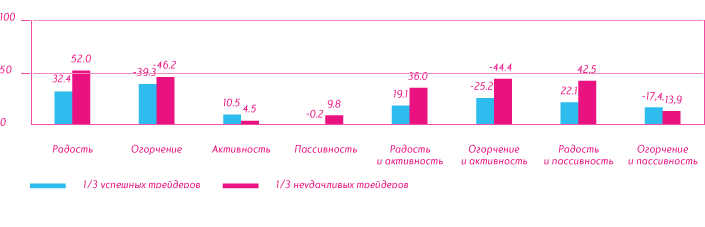

Эмоциональное состояние и успехи на бирже

Луна влияет на прибыль

исследование

результаты

Биржевые игры не для любителей

исследование

пакета средней стоимостью всего в $16 тыс.

пакета средней стоимостью всего в $16 тыс.результаты

Здравомыслие только мешает

исследование

обладали нормальным интеллектом. Каждый участник получал по $20 и в каждом из 20 раундов игры должен был принять решение, инвестировать ли $1 или нет. Ведущий подкидывал монетку, и, если выпадал орел, проинвестировавший участник получал $2,5, а если решка — терял вложенный доллар. Таким образом, вероятность остаться в убытке для игрока, который соглашался инвестировать в каждом раунде, не превышала 13%.

обладали нормальным интеллектом. Каждый участник получал по $20 и в каждом из 20 раундов игры должен был принять решение, инвестировать ли $1 или нет. Ведущий подкидывал монетку, и, если выпадал орел, проинвестировавший участник получал $2,5, а если решка — терял вложенный доллар. Таким образом, вероятность остаться в убытке для игрока, который соглашался инвестировать в каждом раунде, не превышала 13%.результаты

Куда вложить деньги? Инвестирование в интернете. Вложение средств в pamm-счета. Блог памм-инвестора.: января 2012 - трейдеры - научные кролики